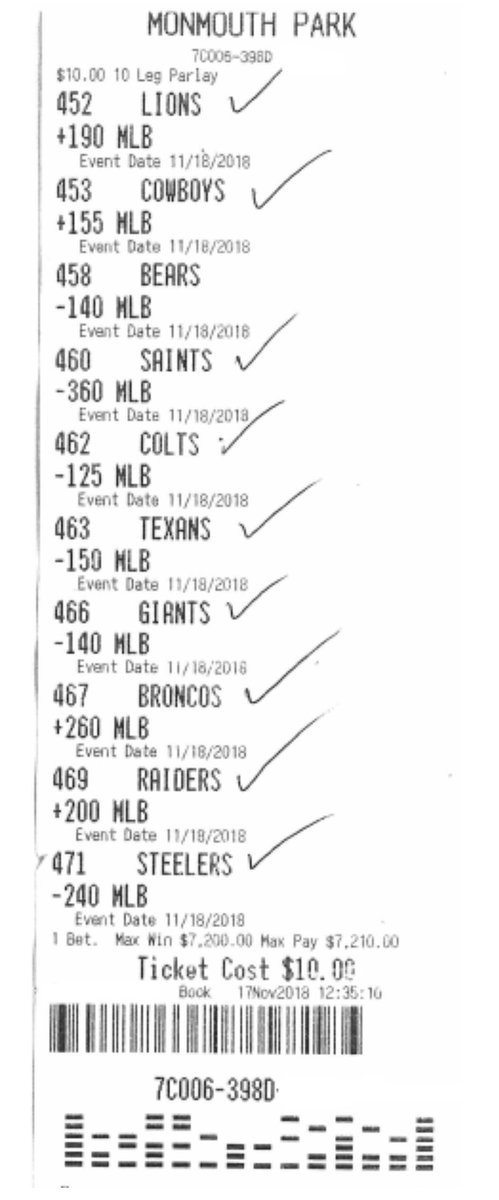

It is a tool for sports betting that helps you learn the different formats and odds offered by online sportsbooks. The odds converter also gives you the implied probability for a bet, based on those odds. It can be a very helpful tool for identifying value wagers.

1 1 Odds

To calculate the payout potential on a bet, it is necessary to know your chances of winning. The odds calculator will present this information to the user in a manner that they are comfortable with.

Decimal Odds

Decimal odds is one of the more popular formats for betting odds. They are easy to read and show the total payout you will receive if your bet wins. This includes the stake amount and profit.

Fractional Odds

The UK uses fractional odds, but you may also find them at US racetracks. The odds can be a good way to estimate the return on a wager, but for newcomers they may be confusing. The odds calculator can convert fractional numbers into American numbers, which are more commonly used in sports betting.

Converting Moneyline to Odds

When you're putting together a budget, it's always helpful to use a calculator that can take into account multiple factors. This is why so many people rely on an odds calculater to balance their budgets.

Betting Odds Converter

The odds convertor is a simple and free tool for converting betting odds. You simply enter the odds in a box. They are then displayed automatically in the appropriate odds format. It's easy to switch from one odds format to another, which is great if your betting involves multiple sports.

You can also find out the implied probability for the odds, which can be a very useful tool to identify value bets. To make sure your bets are smart, it's important to know the implied probabilities.

Probability to Odds Converter

Converting the odds in percentages is a good way to find out the implied likelihood of a bet. It is a method that experienced bettors use to determine the implied probability for a particular outcome. It is often called a probabilities to odds converter, or implied odds calculator. This tool can be used to assess the value of any particular bet.

There are several ways to convert fractional odds in decimal odds. This is done by subtracting the number on the left of the fractional odds from the number on the right, then dividing the result by 100. Add the multiplier, and you have the stake.

FAQ

How does a rich person make passive income?

If you're trying to create money online, there are two ways to go about it. One way is to produce great products (or services) for which people love and pay. This is known as "earning" money.

You can also find ways to add value to others, without having to spend your time creating products. This is called "passive" income.

Let's assume you are the CEO of an app company. Your job involves developing apps. Instead of selling apps directly to users you decide to give them away free. Because you don't rely on paying customers, this is a great business model. Instead, you rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how most successful internet entrepreneurs earn money today. They focus on providing value to others, rather than making stuff.

What is the difference in passive income and active income?

Passive income is when you earn money without doing any work. Active income requires hard work and effort.

You create value for another person and earn active income. Earn money by providing a service or product to someone. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great as it allows you more time to do important things while still making money. Most people don't want to work for themselves. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types to passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

What are the most profitable side hustles in 2022?

You can make money by creating value for someone else. If you do it well, the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. As a baby, your mother gave you life. Your life will be better if you learn to walk.

If you keep giving value to others, you will continue making more. The truth is that the more you give, you will receive more.

Value creation is an important force that every person uses every day without knowing it. It doesn't matter if you're cooking dinner or driving your kids to school.

In reality, Earth has nearly 7 Billion people. Each person creates an incredible amount of value every day. Even if only one hour is spent creating value, you can create $7 million per year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Imagine that you'd be earning more than you do now working full time.

Let's say that you wanted double that amount. Let's say you found 20 ways to add $200 to someone's life per month. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling products, services, ideas, and information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. The real goal is to help other people achieve their goals.

To get ahead, you must create value. Start by downloading my free guide, How to Create Value and Get Paid for It.

How much debt are you allowed to take on?

It's essential to keep in mind that there is such a thing as too much money. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. If you are running out of funds, cut back on your spending.

But how much is too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. That way, you won't go broke even after years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. You should not spend more than $2,000 a month if you have $20,000 in annual income. And if you make $50,000, you shouldn't spend more than $5,000 per month.

The key here is to pay off debts as quickly as possible. This includes student loans, credit cards, car payments, and student loans. After these debts are paid, you will have more money to save.

It is best to consider whether or not you wish to invest any excess income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. However, if you put your money into a savings account you can expect to see interest compound over time.

Consider, for example: $100 per week is a savings goal. That would amount to $500 over five years. You'd have $1,000 saved by the end of six year. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. You'd have more than $57,000 instead of $40,000

That's why it's important to learn how to manage your finances wisely. A poor financial management system can lead to you spending more than you intended.

What is the fastest way to make money on a side hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You need to be able to make yourself an authority in any niche you choose. It means building a name online and offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. So you need to ask yourself how you can contribute value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

But when you look closely, you can see two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

There are pros and cons to each approach. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. You will also find fierce competition for these gigs.

Consulting is a great way to expand your business, without worrying about shipping or providing services. But, it takes longer to become an expert in your chosen field.

If you want to succeed at any of the options, you have to learn how identify the right clients. This can take some trial and error. It pays off in the end.

What is personal financial planning?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You're free from worrying about paying rent, utilities, and other bills every month.

You can't only learn how to manage money, it will help you achieve your goals. It makes you happier overall. You will feel happier about your finances and be more satisfied with your life.

So, who cares about personal financial matters? Everyone does! The most searched topic on the Internet is personal finance. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today, people use their smartphones to track budgets, compare prices, and build wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. It leaves just two hours each day to do everything else important.

When you master personal finance, you'll be able to take advantage of that time.

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

You can increase cash flow by using passive income ideas

You don't have to work hard to make money online. Instead, there are ways for you to make passive income from home.

Perhaps you have an existing business which could benefit from automation. Automating parts of your business workflow could help you save time, increase productivity, and even make it easier to start one.

The more automated your business becomes, the more efficient it will become. This will enable you to devote more time to growing your business instead of running it.

A great way to automate tasks is to outsource them. Outsourcing allows your business to be more focused on what is important. By outsourcing a task, you are effectively delegating it to someone else.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing makes it easier to grow your business because you won't have to worry about taking care of the small stuff.

Turn your hobby into a side-business. It's possible to earn extra cash by using your skills and talents to develop a product or service that is available online.

Articles are an example of this. You can publish articles on many sites. These websites offer a way to make extra money by publishing articles.

Making videos is also possible. Many platforms let you upload videos directly to YouTube and Vimeo. These videos can drive traffic to your website or social media pages.

Another way to make extra money is to invest your capital in shares and stocks. Investing is similar as investing in real property. You get dividends instead of rent.

They are included in your dividend when shares you buy are purchased. The amount of the dividend depends on how much stock you buy.

If you sell your shares later, you can reinvest the profits back into buying more shares. This will ensure that you continue to receive dividends.